Posted

October 9, 2025

Jayne Furnival

Executive Director – Property

jfurnival@langtreepp.co.uk EmailEnvironmental performance has become a standard part of managing commercial property. The shift is being driven by regulatory pressure such as Minimum Energy Efficiency Standard (MEES) regulations, greater expectations from investors around ESG performance, and rising demand from occupiers for sustainable workspaces. For property managers, these pressures are changing how buildings are maintained, upgraded and positioned for long-term value. This blog explores the key trends influencing this shift and what they mean in practice.

Why sustainability is now central to Property Management

Sustainability is becoming integral to how commercial assets are run and plays a central role in how assets are managed, valued, and marketed.

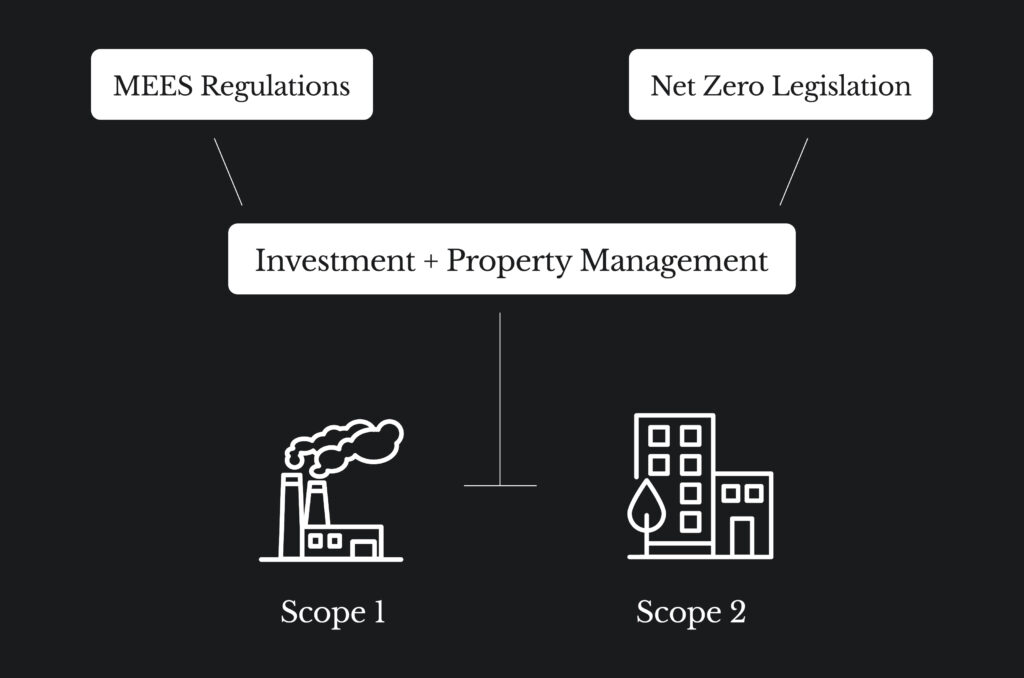

With frameworks like MEES and net zero legislation influencing investment decisions, property managers are factoring environmental performance into everyday tasks, including tracking Scope 1 and 2 emissions. These cover direct emissions from on-site activity and energy purchased for use within the building. Both are critical for understanding a building’s environmental impact and supporting ESG reporting.

Alongside building maintenance, property managers are expected to represent an organisation’s carbon footprint in their reporting, covering all three categories. These metrics are forming the basis of investor due diligence, lender decisions, and tenant expectations.

Support for this direction is growing, with guidance available from groups like the UK Green Building Council (UKGBCS) and the Department for Business, Energy & Industrial Strategy (BEIS), helping property professionals translate national targets into workable building-level strategies. Staying ahead of changes in commercial property regulations is now a key part of strategic planning, and aligning with net zero requirements is becoming essential to long-term asset performance.

Key sustainability trends reshaping commercial assets

Portfolio success requires tactical management decisions. From how data is reported to how tenants are engaged, sustainability expectations are influencing the operational details that sit beneath strategy. The trends below highlight the areas where practical action is starting to define long-term success.

ESG reporting as a core operational requirement

ESG reporting is now a core part of portfolio management. Investors and lenders require transparency around emissions, utility usage, and social impact metrics. These data points influence funding decisions, valuation modelling, and ongoing asset performance.

For property managers, accurate data collection and reporting coordination are critical. They also help strengthen engagement with occupiers, particularly those with their own ESG requirements.

This level of reporting supports long-term capital value by aligning the asset with market expectations. ESG disclosure is one of several operational and strategic pressures that property teams must now navigate, alongside evolving tenant demands, regulatory change and cost management, making it one of many challenges facing commercial property managers in 2025.

Green leasing and tenant partnerships

Green lease clauses are now more widely used as part of tenant negotiations. These agreements often include shared targets for energy use, waste management and water efficiency, helping to formalise sustainability responsibilities across landlord and occupier teams. By encouraging collaboration rather than compliance in isolation, they lay the foundation for stronger long-term relationships.

Rising occupier expectations around environmental performance are making these clauses increasingly relevant. Tenants are actively seeking spaces that align with their values, particularly where ESG commitments are part of their brand. Green leasing supports this shift and also contributes to broader tenant retention strategies by strengthening transparency, shared goals and operational alignment.

Smarter energy management via building tech

Smart systems allow managers to optimise building performance in real time. Energy dashboards, BMS platforms and connected meters help reduce consumption during low-occupancy periods and flag anomalies that might indicate maintenance issues.

For portfolio leads, this data enables comparisons across sites, supports capital planning, and helps prioritise investment based on actual performance. These insights are also critical for maintaining ESG reporting consistency and avoiding last-minute compliance gaps.

Biodiversity, wellness and occupier experience

Beyond emissions, occupiers are looking for buildings that support wellbeing and a positive working environment. This includes access to green space, high indoor air quality, and features that promote health.

Incorporating biodiversity into external spaces can improve local impact and regulatory scores. Certification tools like Building Research Establishment Environmental Methodology (BREEAM) and Fitwel help managers track these measures, while resources from organisations such as the Low Energy Transformation Initiative (LETI) offer practical advice for delivering better outcomes. For portfolio managers, this supports lease renewals and gives assets a distinctive edge in competitive areas.

Together, these trends are creating new expectations for how sustainability is delivered at both building and portfolio level.

Putting sustainability into practice across portfolios

Sustainability isn’t delivered by strategy alone. It relies on day-to-day decisions that build toward long-term outcomes. For portfolio managers, this means making sure that individual buildings operate in ways that support wider ESG targets. That might include reviewing plant efficiency reports, coordinating with property managers to track occupier feedback, or updating service contracts to include measurable sustainability criteria.

Aligning tenant input with asset planning is essential. Feedback about air quality, lighting or shared spaces can reveal pressure points before they affect occupancy or lease renewals. These insights help direct investment to where it will have the most impact over time.

Decisions around retrofitting or rebuilding are also becoming more pressing as MEES regulations tighten. Retrofitting can improve environmental performance while preserving both capital value and tenant continuity. But this approach relies on a clear understanding of building condition, usage patterns and future compliance requirements. Having this information available across the portfolio allows managers to make informed choices, manage risk and identify where investment is most effective.

How Langtree embeds sustainability into commercial Property Management

At Langtree, we see sustainability as a lever for better governance and stronger asset performance. This dual perspective ensures ESG improvements align with compliance targets, investment returns, and occupier expectations. Our property audit provides suggestions of where improvements could be made. Our approach integrates financial oversight with operational delivery, clients gain insight that supports compliance and commercial value.

Building value through sustainability

Delivering strong environmental performance is increasingly linked to stronger financial outcomes. Commercial buildings that align with environmental expectations are more likely to secure long-term tenants, remain compliant, and hold their value as the market evolves.For portfolio managers, integrating sustainability into planning supports resilience and reduces exposure to future regulatory or operational risks. Buildings that are managed with long-term goals in mind tend to perform more consistently and adapt more easily to shifting demands.

PLAN WITH CONFIDENCE

Future-ready assets start with better planning.

Langtree’s property audit helps you identify the gaps, understand the opportunities to develop a strategy for long-term value.